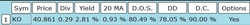

3400 Companies this year are profitable and ready to write some dividend checks to their share holders. How are you positioning yourself to get some of these dividend checks. 3400 companies all writing checks once per quarter.... that makes 13600 times their accountants sit down and put pen to checkbook so to speak. I'm not sure about you but that is a lot of checks and We here are always looking forward to getting some, as many as we can. How are we doing that exactly? There is an old trading strategy called "Dividend Capturing" where you buy the stock just before the ex-date then sell for small profit just after date of record. I know you are probably thinking ... how do I find the right companies to invest in. Well after years of investing we came up with some proprietary trading software just for finding the right stocks at the right time doing exactly what we want them to do.

0 Comments

5/28/2014 0 Comments Stocks With Great Dividends Stocks with great dividends is only half the battle when looking to invest your hard earned money. Yes dividend are great and they are the only stock we invest in. Why you may be asking? Dividends are a portion of the companies profits that they share with the stock holders. If you are a stock holder then you get a dividend check mailed to you four times a year (every quarter).Why are they the only stocks we invest in? Dividend stocks have a tendency for stability and the companies we invest in have a minimum of 10 years of historical payments to investors. Also there are over 300 companies that have successfully increased their dividend pay-outs to their investors every year for more than 10 years and some more than 50 years. So why is it that dividends are only half of the battle when investing? Well I should say that it all depends on your investing outcome. Why are you investing in the first place and what do you want to get out of it? Here at the 10 Minute Trader we are investing for monthly cash flow and capital preservation. Yes we only invest in dividend stocks but dividend stocks that offer stock options has one more key ingredient to the mix and one or two more ways to profi  Is it possible to have a computer software pick winning dividend stocks on a consistent basis? Yeah you can get lucky with almost any software once in a while. But when a software is specifically designed to search for parameters based on definite outlined trading strategy. Then you got some thing there. Ever since the first computer was invented, there have been people wanting to design software to help with their investments, to give them an edge over every one else. Well if you have been trading for more than a certain number of years then you too have some ideas of what to look for when it comes to identifying a winning stock. We like to look at historical performances directly related to certain events on the calendar. That way we know when to buy and who to buy. If the stock has done something in the past over and over again... there becomes a pattern. Software can be designed to recognize this pattern and give us signals to take advantage of this information. Is this going to be an edge over the competition? You bet it is, Patterns tend to repeat themselves |

AuthorJust out of high school I decided to be self employed, after running a successful manufacturing business I had a problem of making more money than I knew what to do with. I started investing, after 23 years of investing I now want to share my strategy with a select few that want an extra edge in their own investing. Archives

May 2024

Subscribe TodayCategoriesAll All About Dividend Investing Best Dividend Investments Best Dividend Paying Stocks Best Dividend Stock Best Dividend Stocks Best Investments Best Paying Dividend Stocks Best Stock Dividends Best Stocks For Dividends Stocks With High Dividends Best Stocks To Buy Best Yielding Stocks Cheap Stocks With Dividends Dividend Aristocrats Dividend Dates Dividend Detective Dividend Etf Dividend Growth Investing Dividend Growth Investment Strategy Dividend Income Dividend Invester Dividend Investing Dividend Investing 101 Dividend Investing Blog Dividend Investing Books Dividend Investing Calculator Dividend Investing For Dummies Dividend Investing Newsletter Dividend Investing Strategy Dividend Investment Calculator Dividend Investments Dividend Investment Strategies Dividend Investment Strategy Dividend Investor Dividend Investors Dividend Paying Stocks Dividend Paying Stocks List Dividend Reinvestment Plans Dividends Dividends Investing Dividends Per Share Dividend Stock Investing Dividend Stock Investing Strategy Dividend Stocks Dividend Stocks List Dividend Yield Dividend Yielding Stocks Dividend Yield Investing Ex Dividend Date Good Dividend Paying Stocks Good Dividend Stocks High Dividend Etf High Dividend Investments High Dividend Stocks Highest Dividend Paying Stocks Highest Dividend Stocks Highest Dividend Stock Stocks That Pay Dividends Monthly Highest Paying Dividend Stocks Highest Yielding Stocks High Risk Investments High Yielding Dividend Stocks High Yielding Stocks High Yield Stocks Income Investing Investing Investing For Dividends Investing In Dividend Investing In Dividend Paying Stocks Investing Strategies Investment Dividend Investment Dividends Investments Stocks To Buy Now Investments That Pay Dividends Investment Stock Jim Cramer List Of Dividend Paying Stocks Money Investing Monthly Dividend Paying Stocks Monthly Dividend Stocks Preferred Stock Preferred Stock Dividends Short Term Investments Smart Investing Stock Dividend Stocks Dividend Stocks That Pay Dividends Stocks That Pay Monthly Dividends Stocks With Best Dividends Stocks With Dividends Stocks With Highest Dividends Stocks With The Highest Dividends Stock With Highest Dividend Top 10 Dividend Paying Stocks Top Dividend Paying Stocks Top Dividend Stocks Top Paying Dividend Stocks What Is The Dividend |

RSS Feed

RSS Feed