2/1/2021 1 Comment Pod Cast, Finally12/14/2020 0 Comments Dividend investing for 12/14/20202/5/2018 0 Comments dividend investing for 2018 Dividend Investing for 2018, you would think it would be similar to 2017 or 2016 or even many years prior to those. I mean, come on, Dividend Investing has been around for over 400 years. It shouldn't vary much from year to year. However this year started out great and should ave kept going at the pace we started, our 1% percent per week was going just great until greed, that green eyed monster came in and sat on my lap. Whispering sweet words of deception and filling my head with thought of grandeur. Well i'm here to say that all my profits so far got wiped out in short week, 9.5% of my total holdings got consumed by the monster this past week. Why? That's a good question. As a teacher of safe investing strategies (Dividend Investing is very safe) why was one of my trading accounts wiped out? I made some questionable trades using options and I guess I needed to be humbled and taught a lesson. I was right on track to earn my 1%-2% this past week and I thought there is more money on the table, why not go big or go home. It made a lovely slogan but not a good trading strategy. BA, Boeing came in with a great 40% return for the week as did HAS, Hasbro. But the other position took those profit along with all of January's profits too. Needless to say this post is basically to say... keep your eyes on your prize and the grass is not greener on the other side of the fence, it just looks like it is. Our goal is 1%-2% per week and I will say... lesson learned. Back to basics and keep with the plan.

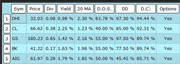

Although our goal for Dividend Investing without options may not be as glamorous as that 1% per week with options. We are going to shoot for 1% per month. 12% per year may seem like an easier goal to achieve than 1% per week for some people. While naysayers and doubting Thomas's may think 12% per year or more may be unrealistic when banks and investment brokers are not coming close to our lofty goals. All that being said, tune into our live broadcast on youtube 3-4 night per week, or... better yet. Join our membership and gain access to our Dividend Stock Trading Software that makes this all possible.  Dividends for cash flow, Investing for cash flow using dividend stocks is not a new idea. In fact this is a strategy that started over 400 years ago. Yes the stock market as we know it today got its start back in the 1590's. A bunch of Dutch businessmen got together and wanted to launch the biggest business in the world. Lacking funds for this endeavor, they offered new investors a share of the profit and literally went door to door selling shares to anyone and everyone. They made good on their promise by delivering over 18% average returns for 198 years before the company was bought out by the Dutch government and disbanded. The strategy is pretty easy, buy the stock before the "EX-Date" and sell after "Date of Record", usually 2-3 days later. Their is no need to hold the stock all year to qualify for a dividend check, just the 2-3 day time period... Then move on to the next dividend stock. Does this work with every dividend stock? Sorry... NO it does not. That is why I have created my dividend stock calculator. This software sifts through all kinds of data, does a few fancy calculations then gives me odds and probabilities of what stock is going to work for me to reach my cash flow investing goals. My current goal is simple enough... 1-2% per week for my efforts. Follow my live video series by subscribing to my youtube channel and ask your investing question there. 7/30/2017 0 Comments dividend investing xom 40%roi..not lXOM, Exxon Mobile last week was one of our last minute tips. When the stock closed on Thursday, there was a clear as day stock tip that should have brought in a 40% ROI for Friday. But... I think the market making read my post and wanted to mess with me and my followers. For what ever reason the stock opened below my target point and never went up for the whole day. Check the link to XOM 's monthly chart and see for yourself https://finance.yahoo.com/quote/XOM?p=XOM ... ExxonMobil has gone below $80 only once all year, moving along sideways very nicely, so why all the sudden the drop below $80? Let's put that aside for a second or two, Monday the stock was $79.80's all day. Tuesday, Wednesday and Thursday, XOM stays above $80, closing $80.87 Thursday. The option play we were looking at had a return of 40% for the day if the stock stayed above $80 come close Friday afternoon. But as you can see the stock never made it over the $80 mark for the day..... Oh well, we can't win them all. Good thing for us all our other tips for the week came in. Just not XOM. 7/27/2017 2 Comments Dividend investing Xom, 40% roi XOM or better known as Exxon Mobile, huge oil conglomerate has a dividend coming up in a few weeks, what does this mean for our investors? Well, if you play your cards right, make the right trade, using the right trading strategy. You can gain as much a 40% ROI for just one day on a relatively safe trade. When I say relatively safe, I mean as long as things go normally, you can make that trade and receive 40% ROI for one day. The trade was for XOM and one of the weekly option strategies that we found last night. In one of our weekly broadcast we found this very lovely little trade and shot it out to our subscribers to see if anyone wanted to make the play themselves. Here is the kicker... if the stock moves up... you make 40%, if the stock doesn't move at all (stays the same) , you make 40%, If the stock moves down.... just a little, you still make 40%. Four indicators all point to the same outcome, 40% ROI for one trading day with this strategy. 5/30/2017 0 Comments Dividend investing, ko Or dps?Where is the best place to put your money... KO or DPS Hello investors, ever wonder how the number three soft drink measures up to Coca Cola, the number one soft drink?

KO has a market cap of $195 Billion and DPS is holding at $16 Billion. Ko is offering 3.27% yield on their dividend and DPS is only offering 2.52% yield. KO has been in business for over 100 years and has increased its dividend payment for over 50 years. DPS may be offering a good yield on its dividend and good growth expectations coming up in the next year, but all that doesn't even come close to what Ko has to offer. KO is number one for a reason both in the stock market and the soft drink arena. |

AuthorJust out of high school I decided to be self employed, after running a successful manufacturing business I had a problem of making more money than I knew what to do with. I started investing, after 23 years of investing I now want to share my strategy with a select few that want an extra edge in their own investing. Archives

February 2021

Subscribe TodayCategoriesAll All About Dividend Investing Best Dividend Investments Best Dividend Paying Stocks Best Dividend Stock Best Dividend Stocks Best Investments Best Paying Dividend Stocks Best Stock Dividends Best Stocks For Dividends Stocks With High Dividends Best Stocks To Buy Best Yielding Stocks Cheap Stocks With Dividends Dividend Aristocrats Dividend Dates Dividend Detective Dividend Etf Dividend Growth Investing Dividend Growth Investment Strategy Dividend Income Dividend Invester Dividend Investing Dividend Investing 101 Dividend Investing Blog Dividend Investing Books Dividend Investing Calculator Dividend Investing For Dummies Dividend Investing Newsletter Dividend Investing Strategy Dividend Investment Calculator Dividend Investments Dividend Investment Strategies Dividend Investment Strategy Dividend Investor Dividend Investors Dividend Paying Stocks Dividend Paying Stocks List Dividend Reinvestment Plans Dividends Dividends Investing Dividends Per Share Dividend Stock Investing Dividend Stock Investing Strategy Dividend Stocks Dividend Stocks List Dividend Yield Dividend Yielding Stocks Dividend Yield Investing Ex Dividend Date Good Dividend Paying Stocks Good Dividend Stocks High Dividend Etf High Dividend Investments High Dividend Stocks Highest Dividend Paying Stocks Highest Dividend Stocks Highest Dividend Stock Stocks That Pay Dividends Monthly Highest Paying Dividend Stocks Highest Yielding Stocks High Risk Investments High Yielding Dividend Stocks High Yielding Stocks High Yield Stocks Income Investing Investing Investing For Dividends Investing In Dividend Investing In Dividend Paying Stocks Investing Strategies Investment Dividend Investment Dividends Investments Stocks To Buy Now Investments That Pay Dividends Investment Stock Jim Cramer List Of Dividend Paying Stocks Money Investing Monthly Dividend Paying Stocks Monthly Dividend Stocks Preferred Stock Preferred Stock Dividends Short Term Investments Smart Investing Stock Dividend Stocks Dividend Stocks That Pay Dividends Stocks That Pay Monthly Dividends Stocks With Best Dividends Stocks With Dividends Stocks With Highest Dividends Stocks With The Highest Dividends Stock With Highest Dividend Top 10 Dividend Paying Stocks Top Dividend Paying Stocks Top Dividend Stocks Top Paying Dividend Stocks What Is The Dividend |

RSS Feed

RSS Feed